| University | Open Polytechnic (OP) |

| Subject | FSC523 Investments Assessment 1 |

FSC523 Investments Assessment 1

Weighting

40%

Learning outcomes

2 Analyse financial calculations and risk factors that impact on investment advice.

3 Evaluate the suitability of investment products, structures and options in terms of their benefits, risks, limitations.

4 Apply environmental and technical factors in an investment context.

Instructions

Complete and submit your assessment according to the Open Polytechnic’s Assessments webpage. This includes information on academic integrity, formatting, word limits and referencing.

• Include your name, student number and the assessment number.

• Number your pages.

Submission

• Submit your assessment in one file.

• Submit your work through your iQualify course.

• Emailed assessments will not be accepted.

• You will receive an automated notice advising you of your successful submission.

By submitting your assessment, you confirm that it is your own, original work.

Stuck! Do not Know Assessment Answers?

Hire NZ Native Experts 24/7.

Case study: Karl and Rui

You and your organisation

Aotearoa Wealth Management (AWM) Limited is registered on the Financial Service Providers Register and is registered to provide investment advice.

You are a financial adviser engaged by AWM. You hold the New Zealand Certificate in Financial Advice (Level 5) with the investment strand.

There are no restrictions on the investment providers you can use within New Zealand.

The clients

You have been approached by a couple who are looking for advice on how to invest a recent inheritance and to meet their financial goals. The clients are Karl, who has just turned 30, and Rui, age 28. The clients live in Hamilton with their two-year-old daughter.

The clients are currently renting and pay $500 per week for their house in Hamilton. They are saving to buy a house of their own. They are looking to buy in three to five years and are wanting to save a deposit of $200,000.

Karl has recently received an inheritance of $200,000 from his grandfather. The clients would like to use half of this for the house deposit and the other half for long-term retirement savings.

Karl is employed as a recruiter and earns $110,000 annually. He does not belong to Kiwi Saver but is looking to join. Rui is employed as a teacher and earns $68,000 annually. She contributes 3% to KiwiSaver and has a student loan of $8,000. Their current living expenses are rent, $500 per week; childcare, $350 per week; food, $250 per week and other living costs, $300 per week. Beyond these expenses, they tend to spend more than they should, and if it is in the bank account, they say it will normally be spent, but they feel they could cut back on this extra spending if it would help them meet their goals.

The clients currently have the $200,000 inheritance in a savings account at their bank and an additional savings account of $20,000, which they add $500 to each fortnight. Rui has $38,000 in her default KiwiSaver account. Karl has a small Sharesies portfolio with a current balance of $8,000. They have no other significant assets and no debt besides Rui’s student loan.

The clients have completed the risk profile questionnaire on sorted.org.nz, and this has advised them that Rui is an aggressive investor and Karl is a balanced investor. Additionally, Karl and Rui are extremely interested in investing in an environmentally and socially conscious way.

The clients have three current financial goals they want your advice on.

• Short term – save for a trip to China to introduce their daughter to Rui’s family in 12 months. They are budgeting $20,000 for the trip.

• Medium term – save $200,000 for the deposit for their first home in three to five years.

• Long term – retire at 60 with an income of $52,000 per year (in today’s dollars), including NZ Super.

Until now, the clients have not given much thought to how they can meet these goals. But they have now approached you to discuss their investment needs.

Section A: Investment recommendations for Karl and Rui

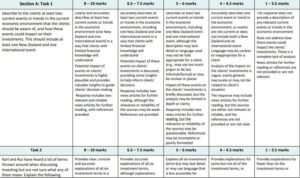

Task 1: Summary of the economic environment

Describe to the clients at least two current events or trends in the current economic environment that the clients should be aware of and how these events could impact on their investments. This should include at least one New Zealand and one international event.

Guidance

The two trends or events could include:

• economic or business cycles

• financial market confidence

• interest rates

• exchange rates

• inflation and monetary policy

• fiscal policy.

Provide a reference (either a URL to a website or an APA reference) to a news article for further reading on each trend.

(Word count guideline: 500 words)

(10 marks)

Task 2: Explain the terms

Karl and Rui have heard a lot of terms thrown around when discussing investing but are not sure what any of them mean. Explain the following investment terms so that the clients can understand them. Include a comparison of the advantages and disadvantages of each option:

• Managed fund and Discretionary Investment Management Services (DIMS).

• Passive management and active management.

• Dollar cost averaging and lump sum investments.

(Word count guideline: 500 words)

(10 marks)

Task 3: Incorporating non-financial factors in investing

Karl and Rui are extremely interested in investing in an environmentally conscious way. Explain three separate ways that environmental information can be incorporated into investment decision-making.

(Word count guideline: 350 words)

(5 marks)

Buy Custom Assignment & Homework Solutions

Pay to NZ Native Writers | Cheap Cost & Plag Free

Task 4: Product recommendation

For each of the clients’ three goals, what investment product(s) would you recommend to investors like Karl and Rui? Explain why this is the best product to meet their goals.

Guidance

You do not need to recommend specific products for this question. Instead, provide a general recommendation of the type of product suitable for each goal, and include the risk level of the fund you’re recommending. For instance, if recommending a managed fund, specify whether it is conservative, balanced or otherwise. You may recommend more than one product for each goal.

(Word count guideline: 500 words)

(10 marks)

Task 5: Provider comparison and recommendation

a) For each of the clients’ three goals, choose two providers who offer the product you recommended in Task 4. Identify and explain key differences between the investment products offered by your chosen providers and how these differences could impact Karl and Rui.

Guidance

Clearly state the name of each provider’s product you are assessing, including a URL link to the relevant information on the company’s website or a third-party comparison website. Include at least three differences between the providers’ products for each recommended investment product. Include a mixture of quantitative and qualitative differences. The differences could include (but are not limited to):

• returns

• fees

• investment style

• socially responsible investing mandate

• ability to access funds.

b) State which of the providers’ products you would recommend for Karl and Rui and explain why. Include the pros and cons of each provider’s products to support your recommendations.

(Word count guideline: 800 words)

(20 marks)

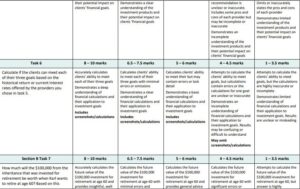

Task 6: Goals analysis

Calculate if the clients can meet each of their three goals based on the historical return or current interest rates offered by the providers you chose in Task 5. For this section, please show your work or include screenshots if you have used an online calculator.

Guidance

Online tools can be used to help answer this question. For example, the savings calculators at sorted.org.nz or the after-tax pay calculator at paye.net.nz. If you use these calculators, please include screenshots of the results to support your answer.

(10 marks)

Section B: Time value of money

For this section, base your answers on the information provided in the case study and not your recommendations in Section A. Assume the clients have invested in a managed fund with a real return of 4% per annum. For this section, please show your work or include screenshots if you have used an online calculator.

Task 7: Future value

How much will the $100,000 from the inheritance that was invested for retirement be worth when Karl wants to retire at age 60? Based on this result, what advice would you give the client about their plan to retire early?

Write your answer as if you were providing advice directly to Karl and Rui.

(Word count guideline: 300 words)

(10 marks)

Task 8: Option comparison

If, instead of receiving the entire inheritance as a lump sum, the clients have the option to collect half the inheritance as an annuity of $5,700 per year over 30 years, with the first payment today, should they take the annuity instead of investing $100,000 for retirement today?

Explain whether you think Karl and Rui should take the annuity or the lump sum. Justify your answer and include any calculations you do to support your recommendation.

Guidance

Assume that the annuity is reinvested at the 4% real return.

(Word count guideline: 150 words)

(5 marks)

Task 9: Options analysis

Calculate how the clients’ financial position at retirement could change if they:

a) use the $200,000 inheritance to buy a house immediately and not save any of it for retirement

b) save the entire $200,000 inheritance for retirement and save for a house separately.

What other factors do they need to consider before choosing either of these options?

Guidance

Assume no other savings for retirement besides KiwiSaver.

(Word count guideline: 400 words)

(10 marks)

Task 10: Ongoing analysis

Clients are often concerned about the performance of their investments and providing them with a regular investment monitoring service can help address their concerns. For each of the below scenarios, what would you include in a general quarterly update to all clients to provide an overview of the impact of the event on investments?

a) The Reserve Bank cuts the OCR by 50 basis points in line with market expectations.

b) Firm XYZ, a large and well-known constituent of the S&P500, files for bankruptcy.

c) The market has declined 10% in the past quarter.

(Word count guideline: 400 words)

(10 marks)

In quest for a professional assignment help?

Flexible rates compatible with everyone’s budget

Marking schedule

Stuck! Do not Know Assessment Answers?

Hire NZ Native Experts 24/7.

Struggling with FSC523 Investments Assessment 1? Our experts at NZ Assignment Help provide professional Finance Assignment Help, covering practical applications in investment analysis, product suitability, risk evaluation, and environmental factors in investments. We guide you in preparing fully referenced, well-structured, and high-quality submissions, ensuring you meet assessment requirements while saving time and effort.

- 31866, 31867 & 31869 Portfolio of Evidence Assessment | Professional IQ College

- 31868 Providing Life, Disability and Health Insurance Services Assessment | NZQA

- 31865 Environment and Concepts Assessment 2026 | Professional IQ College

- 31861, 31862 & 31864 Investment Assets, Financial Instruments and Services Assessment Portfolio of Evidence

- 31863 Economic Solutions Assessment 2026 | Professional IQ College

- 31859 Investment Services Environment and Concepts Assessment | NZQA

- MAMC01801 Capabilities for Managers Assessment 2 Report | UOA

- EC731 Tiriti-Based Early Childhood Education Assessment | NZTC

- EDPROFST 762 Mentoring Professionals Assignment 2 2026 | UOA

- PTY608 Exercise Physiology & Rehabilitation Written Assignment 2026